Leverage the power of Praemium’s award-winning platform

Servicing established and emerging affluent investors, requires access to detailed information at the touch of a button and technology that ensures your time is spent on activities which add value to your clients and maximise your profit.

Our technology is designed to simplify your business and create efficiencies by streamlining, automating and digitising workflows and processes.

We’ve taken Praemium's powerful and robust engine and developed an easy-to-use Adviser Portal that allows you to:

-

onboard clients efficiently

-

adjust, monitor and maintain investment accounts

-

track workflows and fee payments

-

communicate and send reports to your clients, and

-

gain insights into your clients and business so you can scale and grow your business into the future.

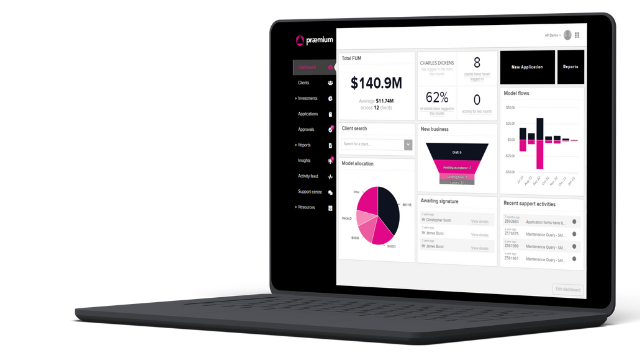

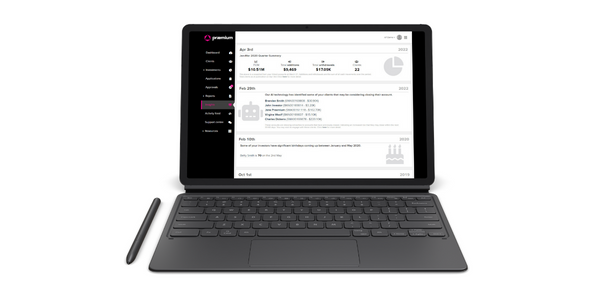

A fully customisable dashboard that you can carry around in your pocket

Adviser Portal is the beating heart of Praemium’s suite of online business management functionality. We refer to it as actionable intelligence for your business, where Adviser Portal contains the information you need, right alongside tools you can use to provide the best customer experience for your clients.

With Praemium, you can build your own dashboard by choosing the windows that provide the access and insights into your clients’ portfolios that you need. And rearrange and resize them so the things you need to see at a glance are always on top.

Driving efficiencies with superior technology

Fast, easy and always available

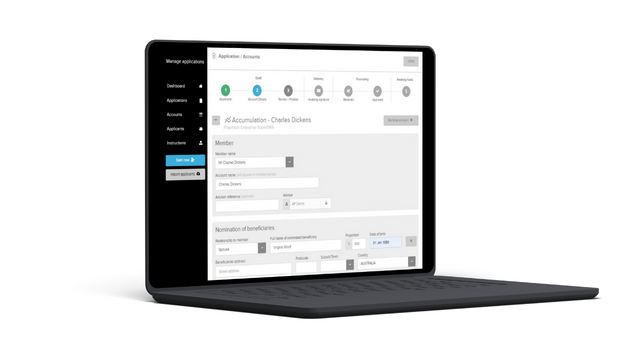

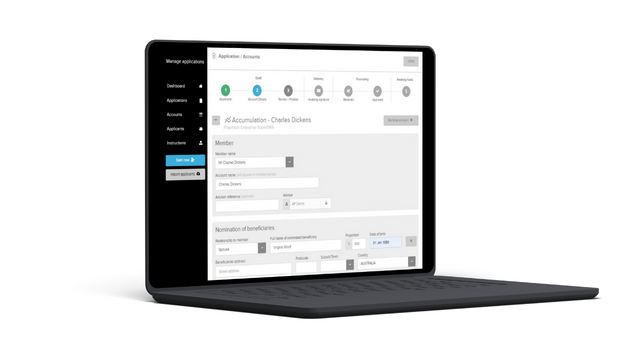

Simple online wizards guide you through the account opening process, where you select assets, set up bank accounts and regular cash flows, and nominate investment sources with single-click options such as in-specie transfers and BPAY cash deposits.

And best of all, you can get your clients’ digital approval for their new account, eliminating paperwork, and automatically submitting applications to Praemium for fast and efficient digital processing, so your investment strategy is implemented significantly faster than traditional postal applications.

Market-leading investment options available from your own digital portal

Build the perfect portfolio for your client with online access to a broad selection of investment options as either single investment assets and/or professionally managed model portfolios.

When re-weighting client assets, Praemium's unique CGT modelling calculator lets you test trade impacts on your client's indicative tax position before committing to investment changes.

Tailor portfolios to your clients’ needs by selecting from a range of customisations or by applying ESG filters that help align their investments with their ethical, social and governance values and beliefs.

Set up and maintain cash flows, then monitor them from an online summary screen that allows you to drill down into individual cash, income, expense and trade transactions.

Tier your clients and automate the level of service you provide them

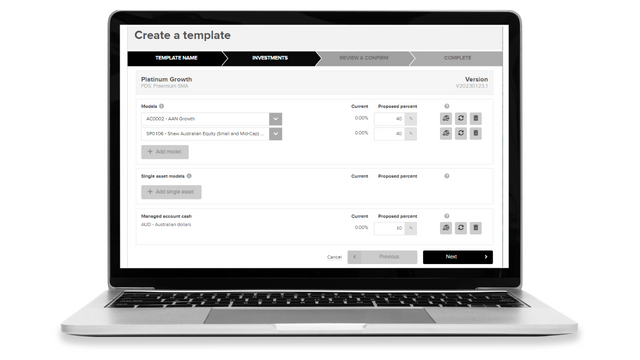

Financial service businesses, like any industry, contain day-to-day operations that involve replicating the same steps. That’s why we work closely with our clients to help alleviate the burden of administration so you can spend more time with your clients.

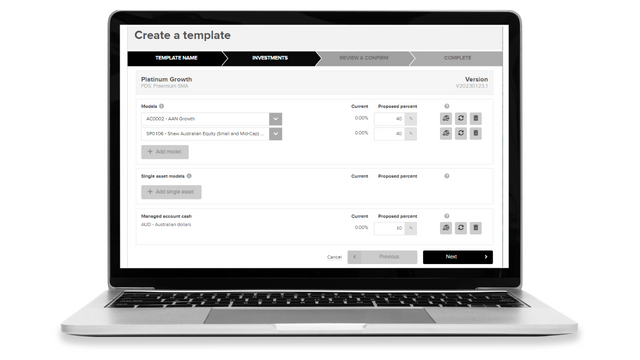

We can help you define common, business-wide templates for tasks such as opening applications, selecting assets, defining and assigning investment strategies, all based on matching your client’s investment goals.

Reduce the administrative burden for you and your clients

Regulations around ongoing advice fees are onerous. But our fee consent functionality stands out in the platform pack for providing an automated and auditable peace-of-mind solution that advisers can depend on.

Advice fee options are flexible in that they allow you to set up both ongoing fee arrangements and fixed term fees for dollar and percentage amounts. Fee consent for new accounts is automatic, as part of the client’s application approval. But ongoing and fixed term fees can be easily managed for all your clients in Adviser Portal.

Our Fees calculator in Adviser Portal is designed to provide a summary of the fees and costs that may be applicable to an account based on the investment amount and your recommended investment strategy.

Data-driven information about your clients and their investments

Praemium's prize-winning innovative functionality provides advisers with knowledge and insights designed to enhance client engagement and strengthen the adviser-client relationship.

The Insights functionality uses data science and machine learning to examine certain client behavioural patterns that may indicate a need for additional advice or guidance. Whether the behaviour patterns are driven by investment or market performance, or a change in their personal circumstances, the adviser then has the opportunity to engage with their client at a time when they are most needing updated financial advice or further guidance about their options or needs.

Data feeds and transaction reconciliation

In addition to market-leading corporate actions and tax management, Praemium facilitates a broad range of external custodial and non-custodial data feeds of transactions covering domestic and international listed and unlisted investments across all asset classes.

Praemium’s transaction matching tool will automatically match over 80% of your non-custodial transactions, making the few remaining transactions immediately noticeable and easy to action, making account reconciliation simple. This can be further simplified with the use of Praemium’s outsourced administration service.

Cash is always up to date and reconciled

Praemium's bank transaction feeds and powerful cash transaction matching mean your client's portfolio is always in sync with their bank trading accounts. And our cash book's unique ability to remember regular deposits and withdrawals makes reconciliation a breeze.

Open integration with other solutions

With the Praemium API Development Hub, you have the tools you need to integrate with most internal or external solutions or systems to further unify client experiences or leverage data in the way you choose. Look at the API documentation site to get an idea of how our API can work for you.